The way you account for your business’s revenue and expenses can have a big impact on your financial picture. Two of the most common methods are the cash basis and the accrual basis of accounting. But what are the differences between them? And which method is right for your business?

This post will break down the key distinctions between these two accounting methods, helping you understand which one is best suited for your needs.

What is Cash Basis Accounting?

The cash basis of accounting is a simple method that recognizes revenue and expenses only when cash is received or paid. It’s a straightforward approach that can be easier to manage for small businesses with simple transactions.

Advantages of Cash Basis Accounting

- Simplicity: It’s easier to understand and track.

- Easy to Manage: Ideal for businesses with straightforward cash flows and limited transactions.

- Less Recordkeeping: Requires fewer complex entries and adjustments.

Disadvantages of Cash Basis Accounting

- Inaccurate Financial Picture: May not accurately reflect your business’s true financial position and profitability.

- Difficult to Forecast: Makes it harder to plan for future cash flows and make sound financial decisions.

- May Not Comply with GAAP: Not suitable for larger businesses or businesses required to follow GAAP.

What is Accrual Basis Accounting?

The accrual basis of accounting recognizes revenue and expenses when they are earned or incurred, regardless of when cash is received or paid. This method provides a more comprehensive and accurate financial picture, especially for businesses with complex transactions, inventory, or credit terms.

Advantages of Accrual Basis Accounting

- Accurate Financial Picture: Reflects the true economic performance of your business.

- Complies with GAAP: Required for most businesses by Generally Accepted Accounting Principles.

- Better Financial Planning: Allows for more accurate forecasting and better decision-making.

Disadvantages of Accrual Basis Accounting

- More Complex: Requires more detailed recordkeeping and adjustments.

- Requires More Expertise: May be more challenging to manage for businesses without accounting expertise.

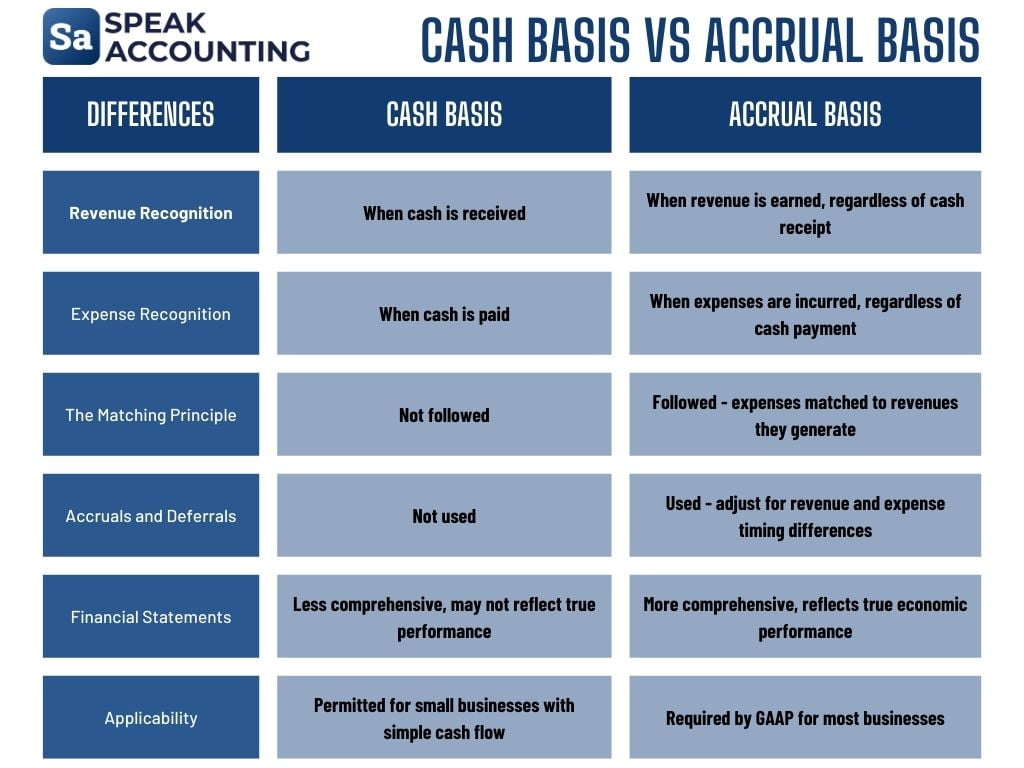

6 Key Differences Between Cash Basis and Accrual Basis Accounting

Now that we’ve established the basics of each method and their advantages/disadvantages, let’s delve into the key differences:

1. Revenue Recognition

| Method | Revenue Recognition |

| Cash Basis | When cash is received |

| Accrual Basis | When revenue is earned, regardless of cash receipt |

Explanation: The cash basis recognizes revenue only when you physically receive the cash. This is simple for tracking, but it might not accurately reflect your business’s true earnings, especially if you offer credit terms. The accrual basis recognizes revenue when you’ve completed the work or delivered the product, even if the customer hasn’t paid yet.

Example: Let’s say you are a freelance writer and you complete a project for a client in February. The client agrees to pay you $500.

- Cash Basis: You wouldn’t recognize the $500 revenue until the client actually pays you (say, in March).

- Accrual Basis: You would recognize the $500 revenue in February when the project was completed, even if you don’t get paid until later.

2. Expense Recognition

| Method | Expense Recognition |

| Cash Basis | When cash is paid |

| Accrual Basis | When expenses are incurred, regardless of cash payment |

Explanation: Under the cash basis, you record expenses only when you pay for them. With the accrual basis, you recognize expenses when they’re incurred, even if you haven’t yet paid for them. For example, if you purchase supplies on credit, you would record the expense when you receive the supplies, even if the invoice isn’t due yet.

Example: Imagine you’re a bakery and purchase a new oven for $10,000 in January.

- Cash Basis: You would record the $10,000 expense in January when you pay for the oven, even if you financed it and make monthly payments.

- Accrual Basis: You would record the $10,000 expense in January when you receive the oven, regardless of when you make the payments.

3. The Matching Principle

| Method | Matching Principle |

| Cash Basis | Not followed |

| Accrual Basis | Followed – expenses matched to revenues they generate |

Explanation: The accrual basis follows the matching principle. This means you match expenses with the revenue they help generate within the same accounting period. For example, if you sell a product in January, you would also record the expenses associated with producing that product in January, even if you haven’t paid for those expenses yet. The cash basis doesn’t follow this principle, potentially leading to an inaccurate picture of profitability.

Example: Imagine you sell a custom-made piece of furniture for $5,000 in June. The cost of materials and labor for that piece was $3,000.

- Cash Basis: You might only record the $3,000 expense if you pay for the materials and labor in June. If you pay for some of those expenses in July, you wouldn’t record them until then.

- Accrual Basis: You would record the $3,000 expense in June (the same month you made the sale) regardless of when you pay those expenses, giving a more accurate view of the profit generated from that sale.

4. Accruals and Deferrals

| Method | Accruals and Deferrals |

| Cash Basis | Not used |

| Accrual Basis | Used – adjust for revenue and expense timing differences |

Explanation: The accrual basis uses accruals and deferrals to adjust for timing differences between when revenue is earned or expenses are incurred and when cash is received or paid. Accruals represent revenue earned but not yet received (like an unpaid invoice), while deferrals are expenses incurred but not yet paid (like prepaid rent). These adjustments ensure that revenue and expenses are recorded in the correct accounting period.

Example:

- Accrual: You invoice a client for $1,000 in services provided in March. They pay you in April. The accrual would record the $1,000 revenue in March when the service was delivered.

- Deferral: You pay your annual insurance premium of $2,400 in January, covering the entire year. The deferral would spread the expense out over the twelve months, recording $200 per month as an expense.

5. Financial Statements

| Method | Financial Statements |

| Cash Basis | Less comprehensive, may not reflect true performance |

| Accrual Basis | More comprehensive, reflects true economic performance |

Explanation: The accrual basis produces more comprehensive and accurate financial statements because it considers both cash transactions and non-cash transactions. It gives a truer picture of your business’s financial position and profitability. The cash basis may only reflect cash transactions, potentially leading to a misleading financial picture.

Example: If you receive a large payment from a client in December for services rendered in November, but also have significant expenses incurred in November that you won’t pay until January, the cash basis would show a much higher profit in December, even though the bulk of the work was done in November. The accrual basis would accurately reflect the profit generated in both months.

6. Applicability

| Method | Applicability |

| Cash Basis | Permitted for small businesses with simple cash flow |

| Accrual Basis | Required by GAAP for most businesses |

Explanation: While both methods are acceptable under certain circumstances, the accrual basis is generally required by Generally Accepted Accounting Principles (GAAP) for most businesses. The cash basis might be appropriate for small businesses with simple cash flows and fewer complex transactions.

Example: A sole proprietorship with limited transactions might find the cash basis easier to manage. However, a large corporation with multiple departments, inventory, and complex financial transactions would need to use the accrual basis to comply with GAAP.

Which Method Should You Use?

- Small Businesses: The cash basis might be suitable if you have a simple business with straightforward transactions. It’s easier to manage, especially in the early stages.

- Larger Businesses: Accrual basis is generally required by GAAP and provides a more accurate financial picture.

If you’re unsure which method is right for your business, consult with a professional accountant or financial advisor.

Resources and Additional Information

- GAAP: https://www.fasb.org/

- IRS: https://www.irs.gov/

Conclusion

Understanding the differences between the cash basis and accrual basis of accounting is crucial for making informed financial decisions.

The right method for your business depends on its size, complexity, and industry requirements. By understanding how each method works, you can choose the one that best suits your needs and helps you make informed decisions about your business’s finances.

Cash Basis vs. Accrual Basis FAQ

What is the difference between accrual and cash basis?

The cash basis records revenue and expenses when cash is received or paid, while the accrual basis recognizes them when they are earned or incurred, regardless of cash flow.

Who uses the cash basis of accounting?

Small businesses, sole proprietorships, and businesses with simple transactions often use the cash basis because of its simplicity.

Who uses the accrual basis of accounting?

Larger businesses, businesses required to follow GAAP, and companies with complex transactions and inventory typically use the accrual basis.

Why is the accrual basis of accounting generally preferred over the cash basis?

The accrual basis provides a more accurate and comprehensive picture of a business’s financial performance, aligning expenses with the revenues they generate. It also allows for better financial planning and forecasting.

Why switch from accrual to cash?

A business might switch from accrual to cash for simplicity if its transactions become simpler or if it no longer needs to comply with GAAP.

Is cash basis allowed under IFRS?

No, IFRS (International Financial Reporting Standards) generally requires the use of the accrual basis for financial reporting.

Can a company use both accrual and cash accounting?

A company can use both methods, but they must be used consistently for different purposes. For example, a company might use the accrual basis for financial reporting and the cash basis for internal management purposes.

Share this content: