Introduction

Accounting formulas are the backbone of financial analysis and decision-making. They provide a quantitative way to evaluate a company’s financial health. In this post, we will delve into the Accounts Payable Turnover Ratio, a crucial formula in accounting.

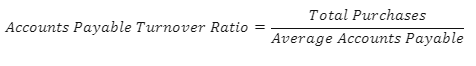

Explanation of the Formula

The Accounts Payable Turnover Ratio is calculated as follows:

The formula consists of two components:

- Total Purchases: This is the total amount of goods or services purchased by the business during a specific period.

- Average Accounts Payable: This is the average amount of money the business owes to its suppliers.

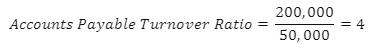

For example, if a company’s total purchases are $200,000 and its average accounts payable is $50,000, the Accounts Payable Turnover Ratio would be:

This means that the company pays off its accounts payable four times in the given period.

Purpose and Significance

The Accounts Payable Turnover Ratio is a measure of a company’s liquidity and efficiency. It indicates how frequently a company pays off its suppliers. A higher ratio suggests that the company pays its suppliers more frequently, which can be an indicator of good financial health.

Practical Applications

The Accounts Payable Turnover Ratio is used across industries to assess a company’s efficiency in paying off its suppliers. It is particularly relevant for businesses with significant amounts of accounts payable, such as manufacturing companies.

Common Mistakes and Pitfalls

A common mistake is interpreting a high ratio as always being positive. While a high ratio can indicate good financial health, it could also suggest that the company is not taking full advantage of credit terms offered by suppliers.

Calculation and Interpretation

Calculating the Accounts Payable Turnover Ratio involves dividing the total purchases by the average accounts payable. The result is a measure of the frequency of payoffs to suppliers. However, interpreting this measure requires understanding the company’s industry norms and payment policies.

Advanced Topics

There are variations of the Accounts Payable Turnover Ratio, such as the Weighted Average Accounts Payable Turnover Ratio, which takes into account the age of each payable.

Conclusion

Understanding the Accounts Payable Turnover Ratio is crucial for assessing a company’s liquidity and efficiency. It provides a valuable tool for evaluating a company’s payment policies and financial health.

Share this content: