Understanding interest revenue is crucial for businesses, as it can contribute significantly to profitability and influence financial statements. This guide explores the fundamentals of interest revenue, covering its definition, accounting treatment, impact on financial statements, and common questions related to it.

What is Interest Revenue?

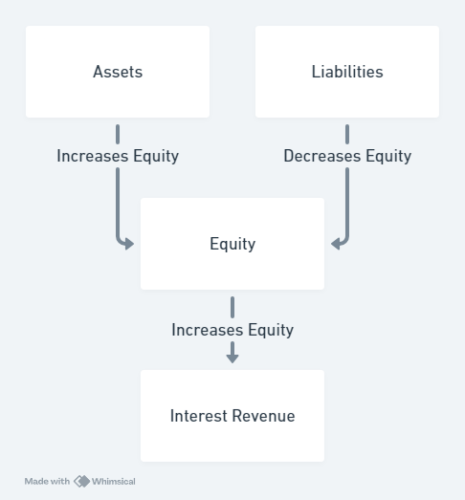

Interest revenue is the income a business earns from lending money or holding interest-bearing investments. It’s the compensation received for the use of funds. Essentially, the borrower pays a predetermined percentage (the interest rate) on the principal amount borrowed over a specific time period.

Examples of Interest Revenue:

- Banks: Banks earn interest revenue from loans they extend to individuals and businesses.

- Investment Companies: These companies generate interest revenue from holding bonds and other debt securities.

- Businesses: Businesses can earn interest revenue from investments made with excess cash or by extending credit to customers.

Key Distinctions:

- Interest Revenue vs. Interest Income: Interest revenue specifically refers to income from operations, meaning income earned through the core business activities. Interest income is a broader term encompassing revenue from both operations and other sources, such as interest earned on cash balances held in bank accounts.

- Interest Revenue vs. Interest Receivable: Interest revenue represents the income earned, while interest receivable is the asset reflecting the right to collect that income. It’s the amount of interest earned but not yet received in cash. Crucially, interest receivable is a current asset, meaning it’s expected to be collected within one year.

Accounting for Interest Revenue:

Accrual vs. Cash Basis Accounting:

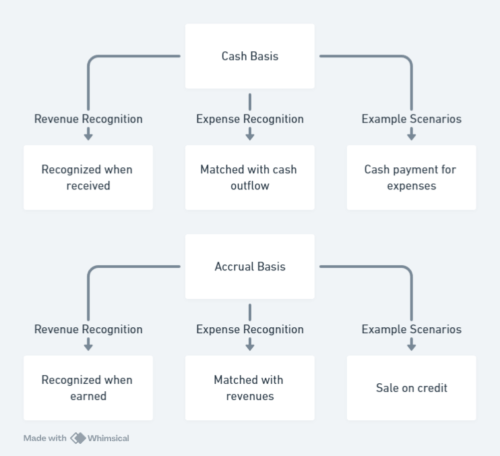

The method used to recognize interest revenue depends on the accounting method a business employs:

- Accrual Accounting: This is the most common method for businesses and recognizes revenue when it’s realized and earned, not just when cash is received. For interest revenue, realization means there’s a reasonable assurance of collecting the interest, and earned means the “service” of providing funds has been used by the borrower. This “service” is gradually provided over time as the borrower uses the funds.

- Cash Basis Accounting: This method recognizes revenue only when cash is received.

Recognizing Interest Revenue:

- Under accrual accounting, interest revenue is recognized proportionally over the time period the interest is earned. This means that the revenue is recognized gradually throughout the loan period rather than all at once when the loan matures. For example, if a loan earns 12% annual interest and matures in one year, the company would recognize 1% of the total interest revenue each month.

Accruing Interest Revenue:

- Definition: Accruing interest revenue means recording the interest earned but not yet received. It’s a key concept in accrual accounting, ensuring revenue is recognized when earned, not just when cash is received.

- Example: Let’s say a company has a $10,000 loan with a 6% annual interest rate. The interest for one month would be $50 ($10,000 x 0.06 / 12). Even if the borrower doesn’t pay the interest until the end of the month, the company will still record $50 in interest revenue at the end of the month.

Understanding “Accrued Interest Revenue” vs. “Interest Receivable”:

The terms “accrued interest revenue” and “interest receivable” are often used interchangeably, but they have slight differences:

- Interest Receivable: This reflects the interest earned that is officially recorded as an asset on the balance sheet. It’s expected to be collected within one year.

- Accrued Interest Revenue: This term can refer to unrecorded interest revenue that has been earned but not yet recorded as an asset (i.e., not yet in interest receivable). This typically happens when interest is calculated on a non-daily basis. For example, if interest is calculated monthly, the accrued interest revenue will be recorded in the journal entry on the last day of the month, increasing interest receivable.

Recording Interest Revenue:

To record interest revenue, a journal entry is used.

- Debit: Interest Receivable (asset account) This increases the interest receivable account, reflecting the company’s right to collect the accrued interest.

- Credit: Interest Revenue (revenue account) This increases the interest revenue account, reflecting the earned income.

Closing the Interest Revenue Account:

At the end of the accounting period (typically a year), the Interest Revenue account is closed. This means the balance in the account is transferred to the Retained Earnings account, which represents the accumulated profits of the business.

- Debit: Interest Revenue account This reduces the balance in the Interest Revenue account to zero.

- Credit: Retained Earnings account This increases the balance in the Retained Earnings account, reflecting the additional profit generated by the interest revenue.

Impact on Financial Statements:

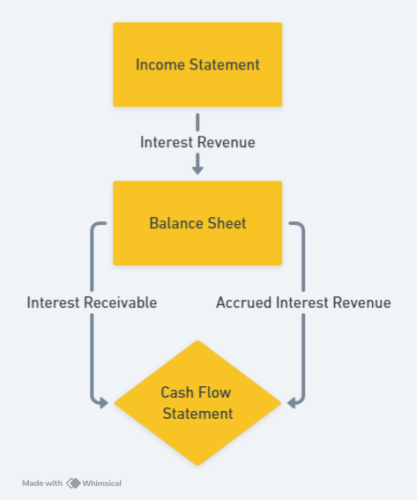

Income Statement:

- Interest revenue is typically presented in the “Other Revenue” or “Non-operating Revenue” section of the income statement.

- “Other Revenue” often includes a variety of income sources that are not part of the company’s primary business activities.

- “Non-operating Revenue” refers to income generated from sources outside the core business operations. It’s important to note that the specific terminology used in financial statements can vary.

- Interest revenue increases net income, contributing to the overall profitability of the business.

Balance Sheet:

Interest Receivable: This account appears as a current asset reflecting accrued interest earned but not yet collected. It’s classified as a current asset because it’s expected to be collected within one year.

Accrued Interest Revenue: If the accrued interest revenue hasn’t yet been recorded in interest receivable, it might be shown as a separate line item within liabilities or equity.

Cash Flow Statement:

- Interest revenue can have a significant impact on a company’s cash flow. When interest is earned but not yet collected, it’s recorded as an inflow from operating activities on the cash flow statement. However, when the cash is actually received, it’s recorded as an outflow from investing activities.

Calculating Interest Revenue:

Basic Formula:

Interest Revenue = Principal x Interest Rate x Time (in years)

- Principal: The amount of money borrowed or invested.

- Interest Rate: The percentage rate at which interest is charged on the principal.

- Time: The duration of the loan or investment, expressed in years.

Compound Interest:

Many loans use compound interest, where interest is calculated on both the principal and accumulated interest. This can result in higher interest revenue over time.

Example: A $10,000 loan at a 5% annual interest rate compounded monthly for 3 months earns $126.83 in interest.

Net Interest Revenue:

Represents the difference between interest revenue earned and interest expense incurred.

Interest Expense: The interest expense a business incurs from borrowing money or issuing debt securities.

Formula: Net Interest Revenue = Interest Revenue – Interest Expense

Common Questions about Interest Revenue:

Interest Revenue and Taxes:

- Interest revenue is generally considered taxable income for most individuals and businesses. The tax rate applied to interest revenue will depend on your specific tax bracket.

Interest Revenue and Financial Ratios:

- Interest Coverage Ratio: This ratio measures a company’s ability to meet its interest obligations. It indicates how many times a company’s earnings before interest and taxes (EBIT) can cover its interest expense.

- Formula: Interest Coverage Ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expense

- A higher interest coverage ratio indicates that the company has a stronger ability to meet its interest payments.

Industry-Specific Examples:

- Insurance Companies: Earn interest revenue on their investment portfolios, which are used to back policyholders’ claims.

- Credit Card Companies: Earn interest revenue on the outstanding balances owed by cardholders.

- Real Estate Investment Trusts (REITs): REITs generate interest revenue from mortgages and loans they provide on commercial and residential properties.

Conclusion:

Understanding interest revenue is essential for business owners. It can directly impact a company’s profitability, financial statements, and tax obligations. By mastering the concepts discussed in this blog post, you can confidently manage and maximize interest revenue for your business.

Remember: The specific accounting treatment and calculation methods for interest revenue can vary depending on the type of investment or loan, industry regulations, and local tax laws. It’s always advisable to consult with a qualified accountant or financial advisor for guidance tailored to your specific circumstances.

Learn:

1- Understanding Accrued Expenses: A Simple Guide

2- Accounting Prepaid Expenses

Share this content: