Welcome back accountants, weather you are an accountant or still studying to become an accountant, depreciation will be a must learn topic for every accountant because it’s one of the most important topics in accounting.

In this blog post we will talk about what is depreciation, how to record it, and what is the idea behind it and why is it important. Let’s jump into it.

What is Depreciation?

Depreciation is: The monetary value of an asset decreases over time due to use, wear and tear or obsolescence. at least that’s what they will teach you, but in simple terms depreciation is the value that the asset loses over time, because every asset has a lifespan.

For example, when you buy a car and 10 years have passed, it will not be in the same condition as when it was new 10 years ago. Rather, it is possible to sell it and buy a new car.

And this is what depreciation is in simple terms.

Why Depreciation is Important?

Depreciation helps organizations declare their true value of assets on their financial statements specifically on the balance sheet, it also helps managers find out the true value of the company assets.

Which assets can be depreciated, and which cannot be?

Now we will talk about which assets can be depreciated and which cannot be.

The following table outlines the depreciable and non-depreciable categories of fixed assets under IFRS:

| Category | Depreciable? | Reason |

|---|---|---|

| Buildings | Yes | Buildings have a finite useful life and wear out over time. |

| Machinery and Equipment | Yes | Machinery and equipment are subject to wear and tear, technological obsolescence, and economic factors. |

| Vehicles | Yes | Vehicles have a limited useful life due to physical wear and tear, technological obsolescence, and regulatory changes. |

| Furniture and Fixtures | Yes | Furniture and fixtures are subject to wear and tear, obsolescence, and damage. |

| Leasehold Improvements | Yes | Leasehold improvements are considered assets with a limited useful life, as they are usually owned by the lessor. |

| Land | No | Land is generally not depreciated as it is considered to have an indefinite useful life. |

| Goodwill | No | Goodwill, an intangible asset arising from factors like brand recognition and customer relationships, is not depreciated but is subject to impairment testing. |

| Patents, Trademarks, and Copyrights | No | These intangible assets are subject to amortization (a similar process to depreciation) over their estimated useful lives. |

| Inventory | No | Inventory is not considered a fixed asset and is accounted for as current assets. |

Depreciation Cycle: A Breakdown

The depreciation cycle refers to the process of allocating the cost of a fixed asset over its useful life. This cycle typically involves the following steps:

1- Initial Recognition

The fixed asset is recognized on the balance sheet at its cost, which includes the purchase price, transportation costs, installation costs, and any other costs necessary to bring the asset into its intended use.

for example, let’s say a company purchased a car for $10,000, the company also paid transportation fees of $1,000.

the total cost of the fixed asset (car) will be $10,000 + $1,000 = $11,000.

2- Useful Life Determination

The estimated useful life of the asset is determined, considering factors such as its expected physical wear and tear, technological obsolescence, and economic factors.

back to our example the company can estimate the useful life of the car for 10 years, which means they will depreciate it for 10% yearly.

3- Residual Value Estimation

The estimated residual value, or the expected salvage value at the end of the asset’s useful life, is determined.

some companies do estimate the residual value, and some don’t. it depends on the asset but most companies estimate the residual value as $0.

4- Depreciation Method Selection

An appropriate depreciation method is chosen, such as straight-line, declining balance, or units-of-production.

3 Common Depreciation Methods

1. Straight-Line Method

- Explanation: This method allocates the cost of the asset evenly over its useful life.

- Calculation: Depreciation expense = (Cost – Residual Value) / Useful Life

2. Declining Balance Method

- Explanation: This method allocates a larger portion of the asset’s cost to earlier years of its useful life.

- Calculation: Depreciation expense = (Carrying value at the beginning of the period) × Depreciation rate

3. Units-of-Production Method

- Explanation: This method allocates the cost of the asset based on its actual usage or output.

- Calculation: Depreciation expense = (Cost – Residual Value) × (Actual units produced / Estimated total units to be produced)

5- Depreciation Calculation

Depreciation expense is calculated using the chosen method and the estimated useful life, residual value, and cost of the asset.

using our previous example, here is the calculation using each method:

Straight-Line Method: Depreciation expense per year = ($11,000 / 10 years) = $1,100 yearly.

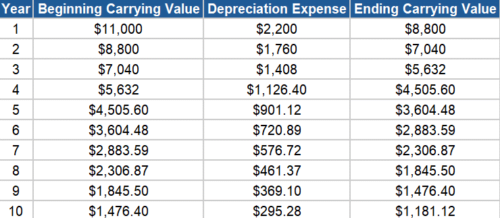

Declining Balance Method (assuming a 20% rate):

- Year 1: Depreciation expense = $11,000 × 20% = $2,200

- Year 2: Depreciation expense = ($11,000 – $2,200) × 20% = $1,760

- And so on.

Units-of-Production Method: If the car is expected to travel 100,000 miles over its lifetime, the depreciation expense per mile would be ($11,000 / 100,000 miles) = $0.11 per mile. If the car travels 15,000 miles in the first year, the depreciation expense would be $1,650.

6- Periodic Recognition

Depreciation expense is recognized as an expense in the income statement over the asset’s useful life.

as accountants we record depreciation on monthly basis and back to our example if we will use the straight-line method and we will depreciate the car with $1,100 yearly this means:

$1,100 / 12 Months = $91.667 Monthly

The Monthly Journal Entry for Depreciation

Debit: Depreciation Expense

Credit: Accumulated Depreciation

Debit: Depreciation Vehicles Expense $91.667

Credit: Accumulated Depreciation $91.667

7- Carrying Value Adjustment

The carrying value of the asset (cost minus accumulated depreciation) is reduced periodically due to depreciation.

this means that the company asset value will decrease after each depreciation period, in our example after the first year the asset value on the balance sheet for vehicles will be $9,900 instead of $11,000.

8- Impairment Testing

The asset’s carrying value is compared to its recoverable amount. If the carrying value exceeds the recoverable amount, an impairment loss is recognized.

When an asset’s carrying value (book value) exceeds its recoverable amount, an impairment loss must be recognized. This loss is recorded as an expense on the income statement and reduces the asset’s carrying value on the balance sheet.

Future depreciation will be calculated based on the new, reduced carrying value. In severe cases, the asset may need to be written off completely.

Example: Impairment Loss for a Car

A company purchases a car for $11,000. Over time, it depreciates, and its carrying value becomes $5,000. Due to an accident, the car’s fair value and its ability to generate future cash flows (value in use) drop significantly below its carrying value.

- Recoverable Amount: Assume the recoverable amount is determined to be $3,500.

- Impairment Loss: $5,000 (carrying value) – $3,500 (recoverable amount) = $1,500

Journal Entry:

Debit: Impairment Loss (Income Statement) – $1,500 Credit: Accumulated Impairment Loss (Balance Sheet) – $1,500

Future Treatment of the Impaired Asset:

- Depreciation: After recognizing the impairment loss, the carrying value is reduced to $3,500. Future depreciation will be based on this new carrying value.

- Disposal: When the asset is finally disposed of, any gain or loss on disposal will be recognized based on the difference between the disposal proceeds and the carrying value.

Journal Entries for Future Depreciation and Disposal:

- Depreciation:

- Debit: Depreciation Expense (Income Statement) – [Annual depreciation amount]

- Credit: Accumulated Depreciation (Balance Sheet) – [Annual depreciation amount]

- Disposal (if proceeds exceed carrying value):

- Debit: Cash (or other asset received) – [Disposal proceeds]

- Credit: Accumulated Depreciation – [Carrying value]

- Credit: Gain on Disposal (Income Statement) – [Excess of proceeds over carrying value]

- Disposal (if proceeds are less than carrying value):

- Debit: Cash (or other asset received) – [Disposal proceeds]

- Debit: Loss on Disposal (Income Statement) – [Excess of carrying value over proceeds]

- Credit: Accumulated Depreciation – [Carrying value]

9- Disposal

When the asset reaches the end of its useful life or is no longer needed, it is disposed of. Any gain or loss on disposal is recognized in the income statement.

Journal Entries for Asset Disposal

Scenario:

A car purchased for $11,000 has reached the end of its useful life. The accumulated depreciation is $10,000, and the car is sold for $500.

1. Disposal with No Gain or Loss:

If the disposal proceeds are equal to the carrying value, there is no gain or loss.

Journal Entry:

- Debit: Cash – $500

- Credit: Accumulated Depreciation – $10,000

- Credit: Car (Asset) – $11,000

2. Disposal with a Gain:

If the disposal proceeds exceed the carrying value, a gain on disposal is recognized.

Journal Entry:

- Debit: Cash – [Disposal proceeds (e.g., $700)]

- Credit: Accumulated Depreciation – $10,000

- Credit: Car (Asset) – $11,000

- Credit: Gain on Disposal (Income Statement) – [Excess of proceeds over carrying value (e.g., $200)]

3. Disposal with a Loss:

If the disposal proceeds are less than the carrying value, a loss on disposal is recognized.

Journal Entry:

- Debit: Cash – [Disposal proceeds (e.g., $300)]

- Debit: Loss on Disposal (Income Statement) – [Excess of carrying value over proceeds (e.g., $800)]

- Credit: Accumulated Depreciation – $10,000

- Credit: Car (Asset) – $11,000

These journal entries reflect the impact of the asset’s disposal on the company’s financial statements, including the recognition of any gain or loss.

Conclusion

The accounting for fixed assets under IFRS is a crucial aspect of financial reporting. The recognition, measurement, depreciation, and impairment of fixed assets are all governed by specific standards, ensuring consistency and transparency in financial statements.

Key points to remember including:

- The definition of fixed assets as tangible items held for use, rental, or administrative purposes.

- The criteria for recognizing fixed assets based on future economic benefits and reliable measurement.

- The choice between the cost model and the revaluation model for subsequent measurement.

- The principles of depreciation, including the selection of appropriate methods and the consideration of useful life and residual value.

- The recognition of impairment losses when the carrying value of an asset exceeds its recoverable amount.

- The disclosure requirements for fixed assets in financial statements.

By understanding and applying these principles, companies can effectively account for their fixed assets and provide accurate and reliable financial information to stakeholders.

Depreciation is the process of allocating the cost of a fixed asset over its useful life. It’s a way to account for the asset’s wear and tear, obsolescence, and economic factors.

Example: Imagine you buy a car for $20,000. You expect it to last 5 years. You can depreciate its value over those 5 years, meaning each year you’ll reduce its value on your financial statements. This reflects the fact that the car is gradually becoming less valuable.

There are several methods to calculate depreciation, but the most common ones are:

Straight-line method: This method allocates the cost of the asset evenly over its useful life.

Declining balance method: This method allocates a larger portion of the asset’s cost to earlier years of its useful life.

Units-of-production method: This method allocates the cost of the asset based on its actual usage or output.

Besides the calculation methods, depreciation can also be classified based on the nature of the asset:

Physical depreciation: This occurs due to wear and tear, usage, and obsolescence.

Functional depreciation: This occurs when the asset becomes less efficient or useful due to technological advancements or changes in business needs.

Economic depreciation: This occurs when the asset’s market value decreases due to economic factors, such as inflation or changes in demand.

Depreciation is known as the systematic allocation of the cost of a tangible asset over its useful life. It’s a non-cash expense that reflects the decrease in value of the asset over time.