Navigating the world of accounts payable can feel daunting, especially for small business owners juggling a million tasks. But mastering the art of recording accounts payable journal entries is essential for accurate financial tracking, healthy cash flow, and informed decision-making. This comprehensive guide will walk you through the process, equipping you with the knowledge and tools to confidently manage your financial obligations.

Understanding Accounts Payable: The Basics

Accounts Payable represents the short-term liabilities owed to suppliers, vendors, or service providers for goods or services received but not yet paid for. Think of it as a list of all the bills your business currently owes. This is a crucial element of your balance sheet, showing your short-term financial obligations.

Bills Payable: A Specific Category

Bills payable is a subset of accounts payable, specifically focusing on the liabilities owed to suppliers for goods and services. Essentially, it’s the money you owe for your inventory, supplies, or materials you’ve purchased.

Visualizing the Relationship

Why Accurate Accounts Payable Management Matters for Small Businesses

Keeping your accounts payable in order is critical for small businesses because:

- Late fees and penalties: Failing to pay invoices on time can result in costly penalties and damage your credit rating.

- Damaged supplier relationships: Frequent late payments can strain your relationships with suppliers, potentially leading to reduced services or increased prices, and even losing valuable suppliers.

- Cash flow issues: Uncontrolled accounts payable can drain your cash reserves, making it difficult to meet other financial obligations, such as paying salaries or rent.

- Difficulty accessing financing: A high volume of unpaid bills can make it harder to secure loans or lines of credit from lenders, limiting your growth potential.

The Initial Process: Receiving and Verifying Invoices

Before recording an accounts payable journal entry, you need to properly handle the incoming invoices:

- Receive the invoice: Ensure you receive a complete and accurate invoice from the supplier, including:

- Supplier name and contact information

- Invoice number and date

- Description of goods or services

- Quantity and unit price

- Total amount due and payment terms

- Verify the details: Check the invoice for accuracy, comparing it to your purchase order or service agreement. Make sure the quantity, prices, and any discounts match what you ordered.

- Approve the invoice: Authorize the invoice for payment based on your purchasing policies and budget. You might have a system of internal approvals depending on the amount involved. For instance, invoices under a certain amount might be approved by a department manager, while larger invoices might require a higher level of approval.

Essential Accounts Payable Journal Entry Types

1. Purchasing Inventory on Credit

Let’s say you purchase $250 worth of office supplies from “Office Depot” on July 10th. The invoice arrives on July 15th. The journal entry would be:

Debit: Office Supplies Expense $250

Credit: Accounts Payable (Office Depot) $250

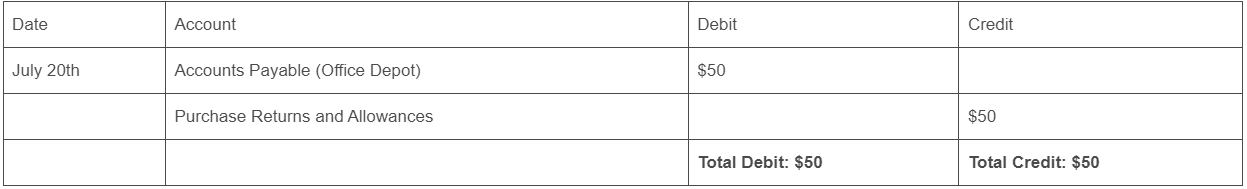

2. Returning Goods

You return $50 worth of office supplies to Office Depot due to a defect. The journal entry would be:

Debit: Accounts Payable (Office Depot) $50

Credit: Purchase Returns and Allowances $50

3. Paying for Services

Your company hires a web developer, “Web Wizards,” to create a new website for $3,000. The developer completes the work on August 1st, and you receive the invoice on August 5th. The journal entry would be:

Debit: Website Development Expense $3,000

Credit: Accounts Payable (Web Wizards) $3,000

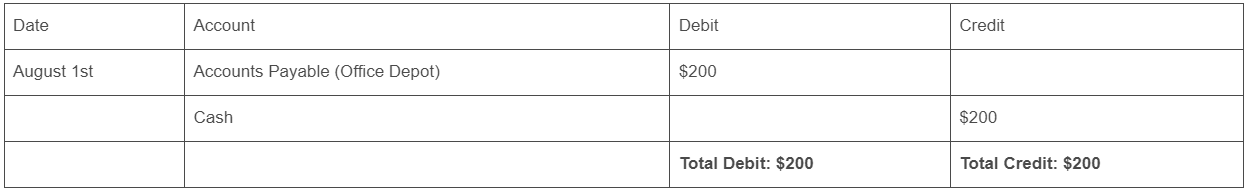

4. Paying off a Bill

You pay Office Depot $200 on August 1st, reducing your outstanding balance. The journal entry would be:

Debit: Accounts Payable (Office Depot) $200

Credit: Cash $200

The Accounts Payable Ledger: Your Tracking Tool

An accounts payable ledger acts as a detailed record of all your outstanding invoices. It tracks the supplier, invoice amount, due date, and payment status for each invoice. The ledger helps you stay organized, monitor your liabilities, and manage your cash flow effectively. It’s a critical tool for accurately reconciling your accounts payable with your bank statements and supplier invoices.

Beyond Basic Entries: Advanced Scenarios

- Discounts: Some suppliers offer discounts for early payments. If you take advantage of a discount, you’ll need to adjust the accounts payable amount and record the discount as a reduction of expense.

- Early Payment Terms: When you make a payment before the due date, you might be eligible for early payment terms, which can save you money. Record the difference as a “discount” in your journal entry.

- Adjustments: Sometimes, invoices might need to be adjusted due to errors, changes in quantities, or returns. You’ll need to record the adjustment in a separate journal entry, debiting or crediting accounts payable accordingly.

Tips for Effective Accounts Payable Management

- Set up payment reminders: Use a calendar, accounting software, or reminders in your email to ensure timely payments and avoid late fees.

- Negotiate payment terms: See if you can secure more favorable payment terms, such as extended payment periods, to improve your cash flow.

- Utilize accounting software: Software can automate the recording of accounts payable, generate reports, and streamline payment processes.

- Reconcile regularly: Compare your accounts payable records with your bank statements and supplier invoices to ensure accuracy and identify any discrepancies.

- Maintain a payment calendar: Track upcoming invoice due dates and prioritize payments based on importance or potential penalties.

- Centralize invoice processing: Having one designated person responsible for managing invoices can help avoid duplication and ensure consistent processing.

- Establish clear payment approval workflows: Define clear processes for who approves payments and under what circumstances, minimizing errors and delays.

- Consider factoring or invoice financing: Factoring is a good option if you need quick cash flow for unexpected expenses or if you have a large backlog of unpaid invoices. Invoice financing is a good choice if you have strong customer relationships and your invoices are typically paid on time.

Internal Control Measures

Implement strong internal controls to minimize the risk of fraud and errors:

- Separation of duties: Assign different people to tasks like receiving invoices, approving payments, and reconciling accounts to prevent collusion.

- Regular audits: Conduct periodic audits of your accounts payable process to identify any weaknesses or inconsistencies.

Additional Resources

- 11 Accounts Payable Best Practices to Streamline Your Process

- Invoice Financing vs. Invoice Factoring: What’s the Difference?

- Internal Controls for Accounts Payable: Types, Best Practices, & More

Conclusion

Effective accounts payable management is a cornerstone of a healthy small business. By understanding the journal entry process, utilizing practical tips, employing accounting tools, and implementing internal controls, you can ensure your financial records are accurate, your cash flow is optimized, and your relationships with suppliers are maintained.

FAQs:

- What if I receive a discount on an invoice? Record the discount as a reduction of the expense in your journal entry.

- How do I record early payment discounts? The discount is recorded as a reduction of the expense and credited to a “discount received” account.

- What if I have to make an adjustment to an invoice? Record the adjustment in a separate journal entry, debiting or crediting accounts payable accordingly.

- Can I use Excel to track my accounts payable? Yes, but specialized accounting software offers more robust features and automation for better management.

- How often should I reconcile my accounts payable? It’s generally recommended to reconcile your accounts payable monthly to ensure accuracy and identify any discrepancies.

Share this content: